Introduction: What Is a Trading Strategy?

A trading strategy is a systematic plan of action that investors and traders employ to make informed decisions about buying or selling financial instruments. These instruments can include stocks, bonds, commodities, currencies, or derivatives. The ultimate goal ? To achieve a profitable return on investment by capitalizing on market movements.

Understanding Your Trading Style

Before diving into the intricacies of trading strategies, consider your unique trading style:

- Day Trading: If you thrive on short-term market fluctuations, day trading might be your forte. It involves executing multiple trades within a single day, capitalizing on price volatility.

- Swing Trading: Swing traders ride the waves of intermediate-term price movements. They hold positions for days or weeks, aiming to capture larger price swings.

- Long-Term Investing: For those with a patient outlook, long-term investing involves holding positions for months or even years. It’s about riding the fundamental trends of the market.

The Need for a Trading Strategy

Novice traders often underestimate the importance of trading with a well-defined plan, often diving into the markets without a strategy in place. However, trading without a systematic approach can lead to uncertainty, emotional decision-making, and inconsistent results. A trading strategy provides traders with a systematic and logical approach, eliminating guesswork and impulsive actions. It instills confidence, ensuring that every trade executed has a clear purpose and justification.

Benefits of a Trading Strategy

- Clear Decision-Making: A trading strategy provides traders with a clear framework for decision-making. In the fast-paced and often unpredictable world of financial markets, having predefined rules and guidelines helps traders stay focused and objective.

- Analysis and Improvement: One of the significant advantages of having a trading strategy is the ability to analyze and improve trading performance over time. By maintaining a trader’s journal, traders can track and review their trades, documenting the rationale behind each decision and noting the outcome. This retrospective analysis provides valuable insights into the effectiveness of the strategy, identifying strengths and weaknesses.

- Risk Management: A trading strategy includes risk management rules that help traders protect their capital and mitigate potential losses. By incorporating risk management techniques such as setting stop-loss orders, position sizing, and defining risk-reward ratios, traders can ensure that individual trades align with their overall risk tolerance and investment goals.

- Consistency and Confidence: Trading without a strategy can lead to inconsistent results and erode a trader’s confidence. Having a well-defined trading strategy instills discipline and consistency in a trader’s approach. Consistently following a trading plan reduces the likelihood of impulsive and emotionally-driven decisions that can sabotage trading success.

Markets for Developing Your Trading Strategy

Choose your battlefield wisely:

- Stock Market: Equities offer diverse opportunities.

- Forex Market: Currency pairs for global exposure.

- Futures Market: Commodities, indices, and interest rates.

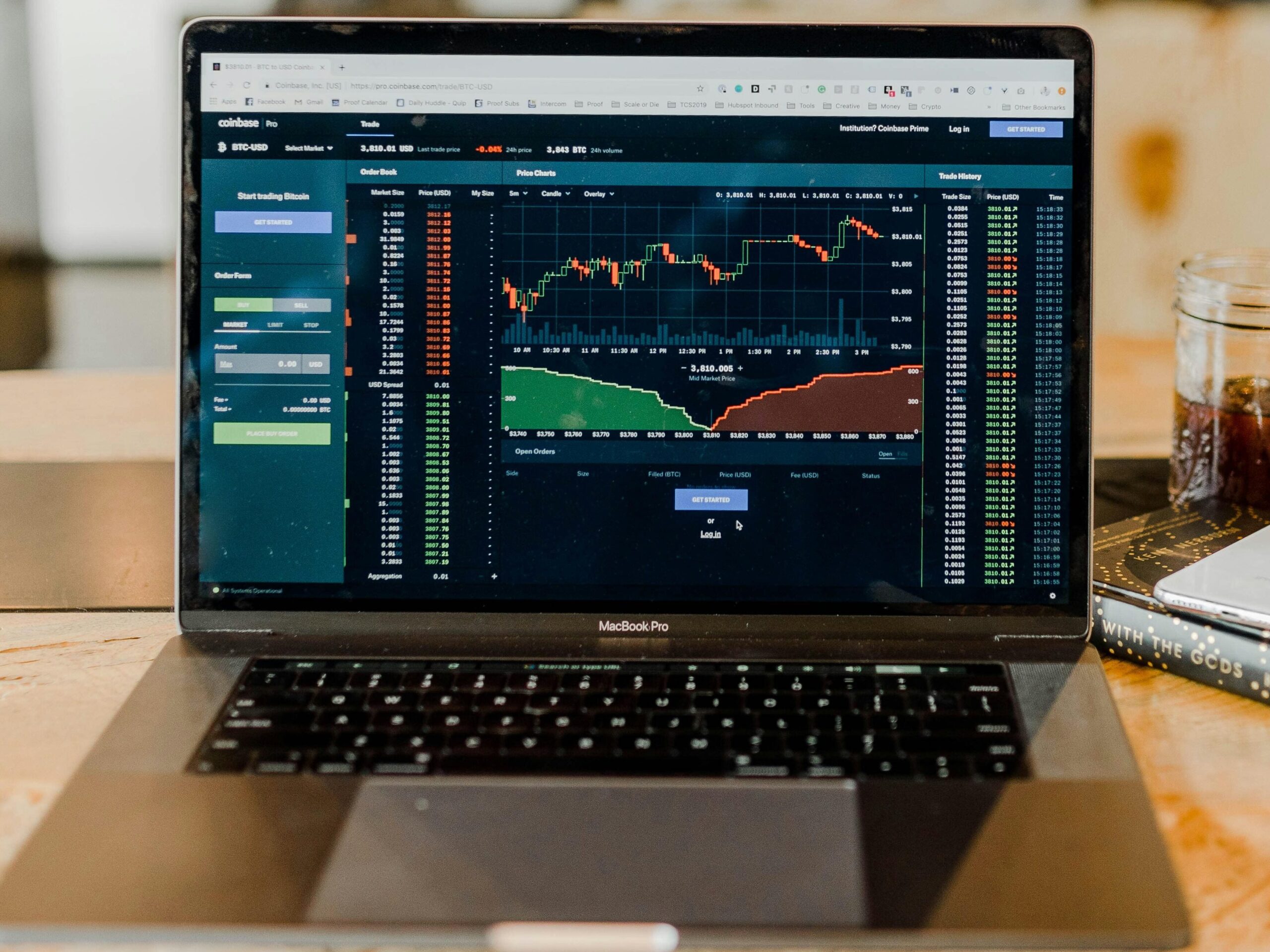

- Cryptocurrency Market: Digital assets with high volatility.

The Best Trading Strategy: Is There a One-Size-Fits-All?

No magic formula exists. Successful traders come from diverse backgrounds. Learn from case studies and adapt strategies to your unique circumstance

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Trading and investing in financial markets involve risks, and individuals should seek professional advice or conduct thorough research before making any investment decisions.

Hello,

I like your blogs, it’s mean to a day to day life of a trader’$ ,keep motivating us with real value of the markets.